If you are like us, you’ve been reading a lot about the housing market. There is a lot of speculation about a surge coming. Some people and news outlets are talking about a big come back next year. We have different thoughts about the Boom!

The Boom sounds great! Especially if you are trying to sell your house. Especially if you are a realtor! We love when the housing marketing is rebounding. However, we are skeptical it’s about to happen.

The numbers and the market are not adding up for us to have a big surge. More and more companies are struggling – don’t believe us, look around. A few places to check in: oil and gas sector. Farming. Home builders. A lot of these sectors are all feeling the pinch with our new government.

Let’s Look At The Facts:

Some parts of the Canadian market ― such as Greater Vancouver and the single-family home market in Greater Toronto ― have seen price declines over the past few years, which news “experts” and “banks” have claimed, ” this helps improve affordability.” These are actual quotes from experts!

We are not sure about you, but we feel $1MM for a condo or a starter home is still way beyond the “affordability” mark. Here are some stats about living in Vancouver.

“Zoocasa noted that the benchmark home price in Vancouver is $1,156,050 CAD, and that the required income to purchase a home at that cost is $164,844 CAD. However, the actual median income in the city is $65,327 CAD, which represents an income gap of $99,517 CAD.”

Yes, you read that correctly. “Experts” are telling us there is improved affordability. The math suggests there is an income disparity of almost $100,000.00 in order for the “average” person to buy a home.

So, those experts talking about “affordability” in Canada seem to have missed the mark.

A recent report from National Bank of Canada said affordability improved for three straight quarters this year (in Canada), although prices still remain elevated, compared to incomes, in many cities.

Think about that… affordability improved – prices remain elevated! How many of you received a 5% increase in your wage this year to help with inflation and affordability? Hands up?!

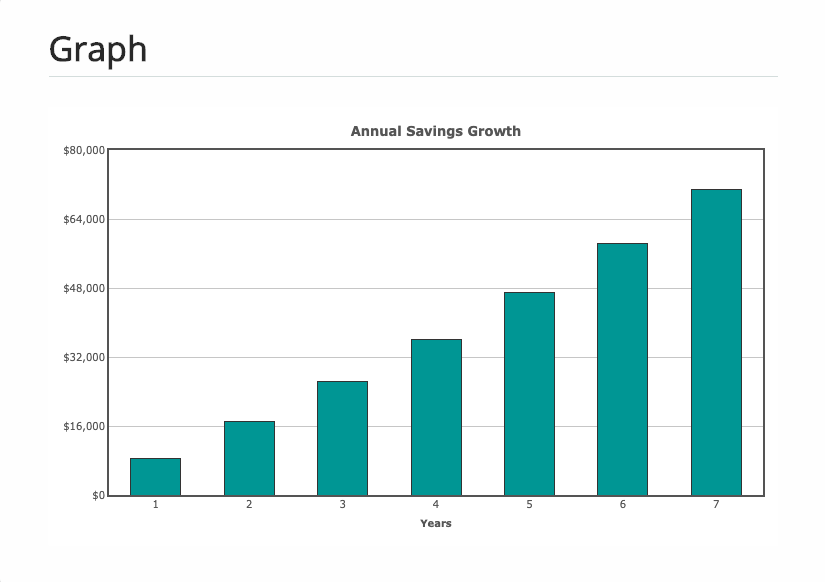

Saskatchewan is part of this. Home prices are not what they used to be in our city (the Saskaboom seems to have slowed… prices have yet to catch up) and if you want to afford an average home in the city, at the average price this is what it will look like for you:

Average home price: $354,400

Needed income: $74,539

Down payment needed:$70,880 (with 20% down so you don’t have to pay CMCH) **** (see note below)

Years to save that downpayment on average: 7.5 years

(all of that falls on the assumption that for 7 years you do nothing but save $1000 per month in order to save for a down payment, an emergency slush fund + your closing costs).

These are sobering numbers. Most families (especially with children) will not be able to do this without help from family or friends or other means.

What’s On The Horizon for The Housing Market?:

Prices are expected to accelerate in 2020. Home builders are needing to charge more for materials and PST so home prices are suggested to be increasing next year.

Taxes will be going up as they do every year.

The only thing that might remain the same is interest rates. However, we believe we will soon be seeing an increase in those as well.

We believe that affordability is going to be worsening again soon. Not improving.

The policies that were put in place by the government to help home owners greatly missed the mark. Stress tests and new home buyer options are not actually helping buyers. The Liberal government’s first-time homebuyer incentive or the Conservatives’ proposal to extend insured mortgage amortizations to 30 years also just push the can further down the road. If you cannot afford a home with 20% down at a 25% amortization at the lowest price interest rates have been in decades, please know you cannot afford a home with higher interest rates with longer payment terms.

Our Predictions for The Housing Market:

As we move into 2020, the rate reset of five-year fixed rate mortgage holders will probably move higher again, 75 to 80 basis points. For us, that’s a red flag and a huge risk for 2020, that potentially, there’s another bout of weakness coming for housing across the country.

Final Thoughts:

The news is full of propaganda. The “experts” writing about the new “2020 Boom” are people who need the economy (and people like you) to start buying real estate and other material items. They are typically not concerned about what you can actually “afford” or the new debt you acquire.

As always, if you need help buying or selling your home do not hesitate to reach out.

Gregg Bamford

Ryan Bamford

*** CMHC stands for Canadian Mortgage and Housing Corporation. It is mortgage default insurance. The default insurance costs homebuyers 2.80% – 4.00% of their mortgage amount.***