The Canadian Real Estate Association(CREA) estimates a home buyer in Saskatoon with a 20 per cent down payment would have to come up with an additional $48,000 to qualify for a single-family home with a benchmark price of $306,900 due to the stress test, or lower their target price to $259,000.

How Does The Stress Test Impact Housing?

For many people, this is making home ownership unrealistic.

It is the same in Regina, where a home buyer would have to come up with an extra $43,000 to qualify for a $274,000 home with a 20 per cent down payment, or lower their target to $231,000, the CREA said.

The Canadian Home Builder’s Association estimates over 150,000 buyers have been taken out of the market due to the mortgage stress test, with over half being first-time buyers.

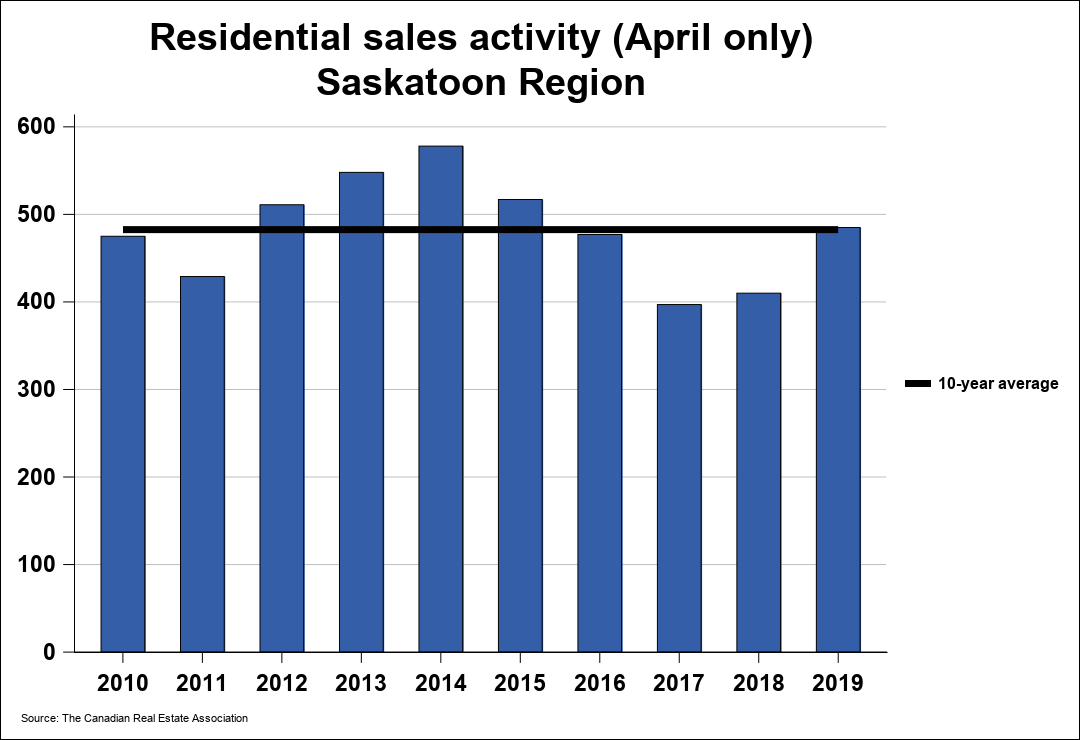

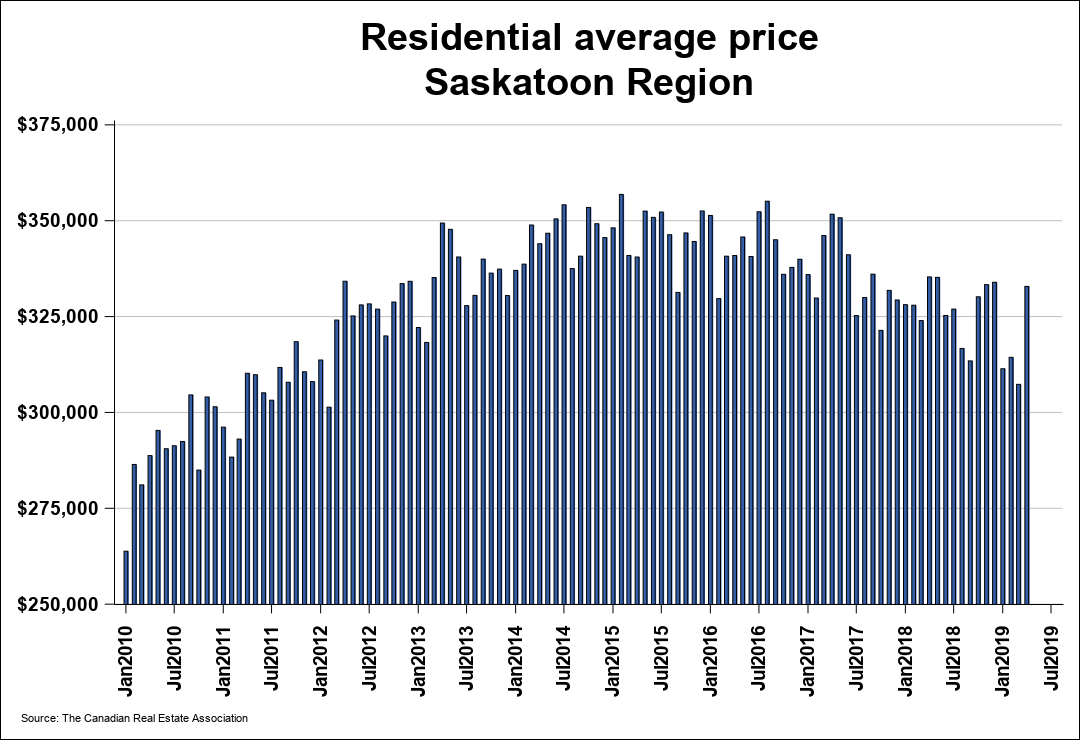

The average house price in Saskatoon is $283,700. In March 2019, Saskatoon’s house prices down 2.7% year-over-year. Home prices depend on the size, location, amenities, the age and condition of the apartment, townhouse or house.

What About Interest Rates & A Stress Test?

With the slight upturn in the economy, there is a potential for interest rates to increase as well.

“Bank of Canada Governor Stephen Poloz said he still believes interest rates are poised to continue rising once headwinds to growth dissipate.”

What Should I Do?

Everyone’s situation is different.

Some people will qualify for homes and will be able to save their downpayment and get into the average home price – which is currently at $320,000K.

For other people – saving 20% for a down payment and acquiring a 5 Year Variable Closed. 3.45% (Special Rate is TD Mortgage Prime Rate – 0.65%) at 3.47% is going to be hard.

If your lender offers a rate of 2.99%, you’ll have to use the 5.14% benchmark rate in your stress test. If you make a 20% down payment and your lender offers a rate of 3.49%, you’ll have to qualify using a rate of 5.49%.

Final Thoughts:

You should consider all of these situations when you go to purchase a home. If interest rates rise 100 basis points (or 1%) will be able to carry your mortgage on your current home? If not, you should consider saving more money or consider locking in your mortgage.

As always, if you need help buying or selling your home we are here to help.

Gregg Bamford and Ryan Bamford