This has been a difficult year to navigate real estate.

There have been consistent interest rate hikes. There have been new mortgages rules applied and of course – there is the stress test.

It appears that the changes are not over yet.

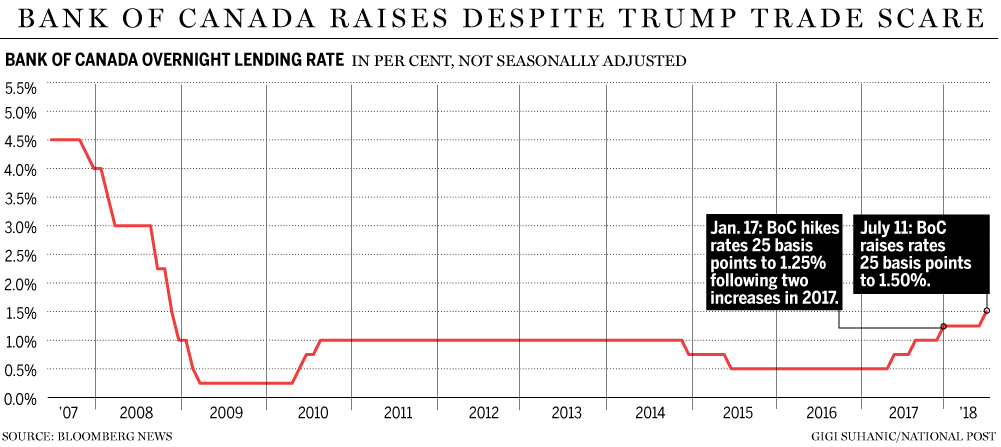

“The Bank of Canada (BoC) is widely expected to raise its trend-setting interest rate by another quarter of a percentage point to 1.75%, on Wednesday. It would be another step in the gradual move toward higher rates under the stewardship of BoC governor Stephen Poloz. And it could also nudge a growing number of Canadians burdened by debt closer to insolvency.”

What does this mean for you as a homeowner or if you are home purchaser?

In general, nearly 80% of Canadians of all ages said that with interest rates rising, they’ll have to be more careful about how they manage their money. So, if you are trying to sell your home this means price it right. THE FIRST TIME! This is more important than ever.

If you are a first time home buyer and you know interest rates are going to be going up throughout the next year – it would be wise to budget an extra $100 a month into your mortgage. It would be great to ensure you can support an additional $1320 a year on your mortgage.

What’s Next?

If you’ve had your mortgage for a while than you have yet to feel the full effects of the interest rate hikes because you’ve most likely been locked into a fixed mortgage. Fixed mortgage rates are the most common types of mortgages in Canada.

When your mortgage comes up for renewal you might feel a bit of sticker shock.

As always, if you need help buying or selling your home we are here to help.

Gregg Bamford and Ryan Bamford