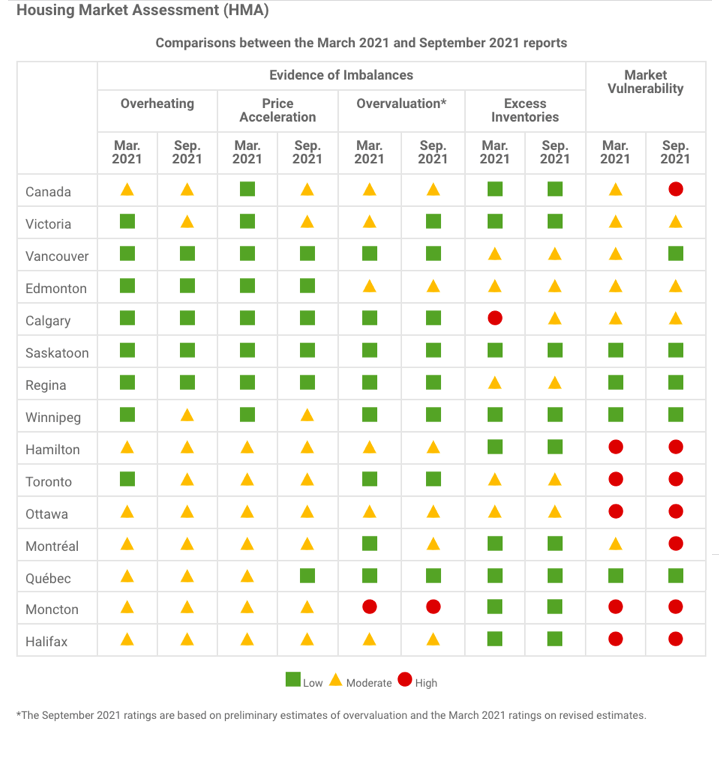

The CMHC released its September housing market a.ssessment. Click here to read the full article.

Overall, Canada as a whole is still seeing a high degree of market vulnerability.

Saskatoon (although low on supply right now – does not appear to have the market vulnerability other cities are facing. However, Saskatoon homes are up nearly 20 per cent to $314 per square foot. Our city also saw affordability change during the pandemic.

As a friendly reminder, (when you are reading this blog), The HMA does not assess affordability, as affordability relates to the cost of housing that meets the needs of a household at a reasonable share of their income. This aspect of housing is not covered in the HMA. It is also a big data point missing as “affordability” is out of reach for many Canadian’s.

Even in a balanced housing market with a low level of market vulnerability, households in lower-income brackets may still have difficulty finding shelter that is affordable and meets their needs. Households in the higher-income brackets are also having difficulty finding affordable housing as down payments are sometimes as high as $200,000.

How Do They Qualify Data For Their Chart:

(The below information is from the GMHC Report)

The current Housing Market Assessment is based on data up to the end of the second quarter of 2021 and market intelligence up to August 2021. Results for Canada and 14 CMAs are provided in the report.

The HMA identifies significant imbalances in the housing market that could potentially increase the risk and consequences of a housing market downturn. This could include a price correction. Such scenarios can have significant negative impacts on households, the housing industry, and the economy more broadly.

The results contained in the HMA help key stakeholders and policymakers make appropriate decisions to generate a smooth transition towards more balanced market conditions.

The HMA framework looks at the overall state of the housing market. It looks for potential imbalances by assessing four key factors:

Overheating: when demand significantly outpaces supply

Price acceleration: when house prices rise at an increased pace over a sustained period

Overvaluation: when house prices differ significantly from their level consistent with housing market fundamentals (such as labour income, population, and interest rates)

Excess inventories: when there is an unusually high level of vacant housing units

On their own, each factor is assigned a degree of imbalance following a three-point scale:

Low

Moderate

High

Together, the factors make up the state of a housing market’s vulnerability. Simply, the more imbalances there are, the more vulnerable the housing market is.

As always, if you need help buying or selling your home Gregg Bamford and Ryan Bamford are here to help.