Interest rates

Interest rates in Canada are set by the Bank of Canada. They are used to influence the cost of borrowing for consumers and businesses. When interest rates are low, it makes borrowing cheaper and can lead to increased spending and economic growth. When interest rates are high, it makes borrowing more expensive and can slow down spending and economic growth.

The Bank of Canada (BoC) announced a 0.25% rate hike on January 25, 2023. This increase brings the Bank of Canada’s policy interest rate to 4.5%, and it is the eighth rate hike over the past 12 months. As a result, mortgage rates have also been increasing making it less affordable for Canadians to purchase or refinance their homes.

Low interest rates have the potential to fuel a housing market bubble, as people may be more likely to purchase homes they may not be able to afford in the long term if rates were to rise. Additionally, low interest rates may also lead to increased consumer debt as people may be more likely to borrow money at lower rates.

It is important to note that the interest rates can change and can also be affected by other factors such as the country’s economic performance, inflation, and global events. It is always recommended to consult with a financial advisor and to have an understanding of the current rate and how it may affect your financial situation.

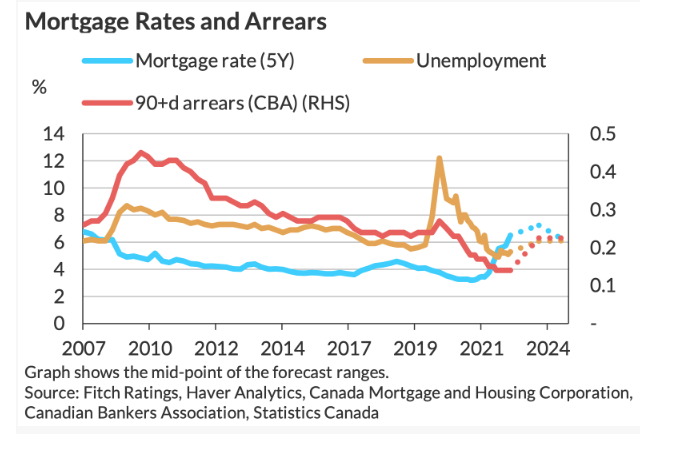

The default rate on homes in Canada was relatively low in recent years. This can be attributed to factors such as a stable economy, steady job market, and low interest rates which makes borrowing more affordable. However, the economic scenario has been drastically changed due to COVID-19 pandemic and its aftermath, which may have an impact on the default rate.

Canadian Mortgage Delinquency Rate To Rise Sharply

Canada’s mortgage delinquency rate will rise sharply in the coming months. Fitch Ratings has forecast an 0.25% delinquency rate in 2023, up 11 basis points (bps) from this year. The increase is very sharp, considering that it implies over 75% more mortgage delinquencies. The rate is still very low, and largely balancing the low rates typical of a bubble.

As always, if you need help buying or selling a home reach out to Gregg Bamford of Ryan Bamford.