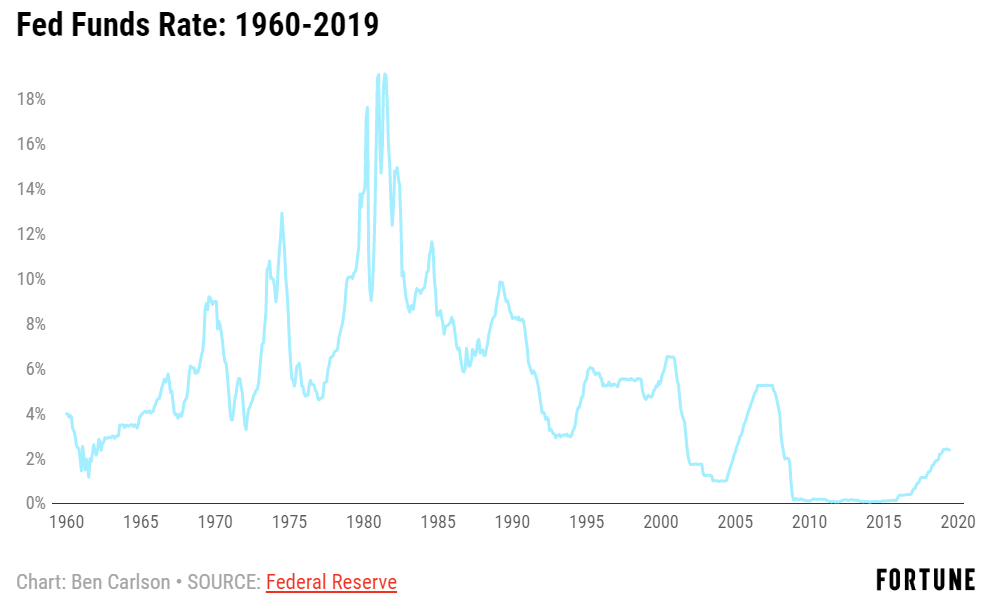

If you’ve been reading our blog, we’ve been talking about this a lot this year. We are going to continue to talk about this as it is important for the Saskatoon economy and housing market. The “this” we are referring to is – interest rates and the economy.

It happened! The feds in the USA lowered the interest rates again. This is the second time they have cut interest rates this summer! A weakening global economy and continued trade fears convinced U.S. Federal Reserve chair Jerome Powell to cut interest rates yesterday.

If you’ve been following us and waiting for those lower rates, those same global forces are on their way to us. The last lowering of the interest rate in the USA will likely force Bank of Canada Governor Stephen Poloz to follow suit.

How Does This Interest Rate Affect Canada?

Despite the fact that the quarter point cut was widely expected (meaning there had been downward pressure for quite some time), the move had an immediate effect on the Canadian dollar which fell promptly after Powell’s announcement. This is also bad news for Canadians who had any travel planned this year – our exchange rate is currently in the gutter.

While Powell said shrinking industrial activity justified the cut, he insisted that he and his advisers expect the economy to continue to grow, and predicted there would likely be no more interest rate cuts this year.

Even though they suggest that there will be no more rate cuts this year – the economy (globally) is not doing well. Canada, the UK, Australia and even China are all seeing a downturn. In order to stimulate the economy, they may in fact have to engage in another rate cute.

How Will This Affect Saskatoon’s Housing Market?

If interest rates are lowered again in Canada it means buyer beware. The recession is imminent.

It means the banks and feds are playing a game of “kick the can down the street.” They will lower interest rates, which probably means you can purchase a larger home… but is your job stable enough to get through a market downturn?

Somethings to think about when buying in a recession:

- Can you afford a new home with one income?

- If they increase interest rates by 100 basis points next year, will you be able to afford your home?

- Do you have enough money saved for 4 months of: payments, living life, etc?

Our Final Thoughts:

A lower interest rate is great for those people who have saved enough money, have a stable and secure and are ready to ride out what is about to happen. If you are not one of those people, if you are the 50% of Canadian’s who are living pay check to pay check – we suggest holding off on house hunting or home selling until the economy returns to stable times.

As always, if you need help buying or selling your home please contact Gregg Bamford or Ryan Bamford.